Irs Tax Payments For 2024

Irs Tax Payments For 2024. Estimated taxes are “pay as you go,” according to the irs, and are spread across four payments. Click on each irs payment option below to learn more about common ways to pay your federal income taxes online, what each.

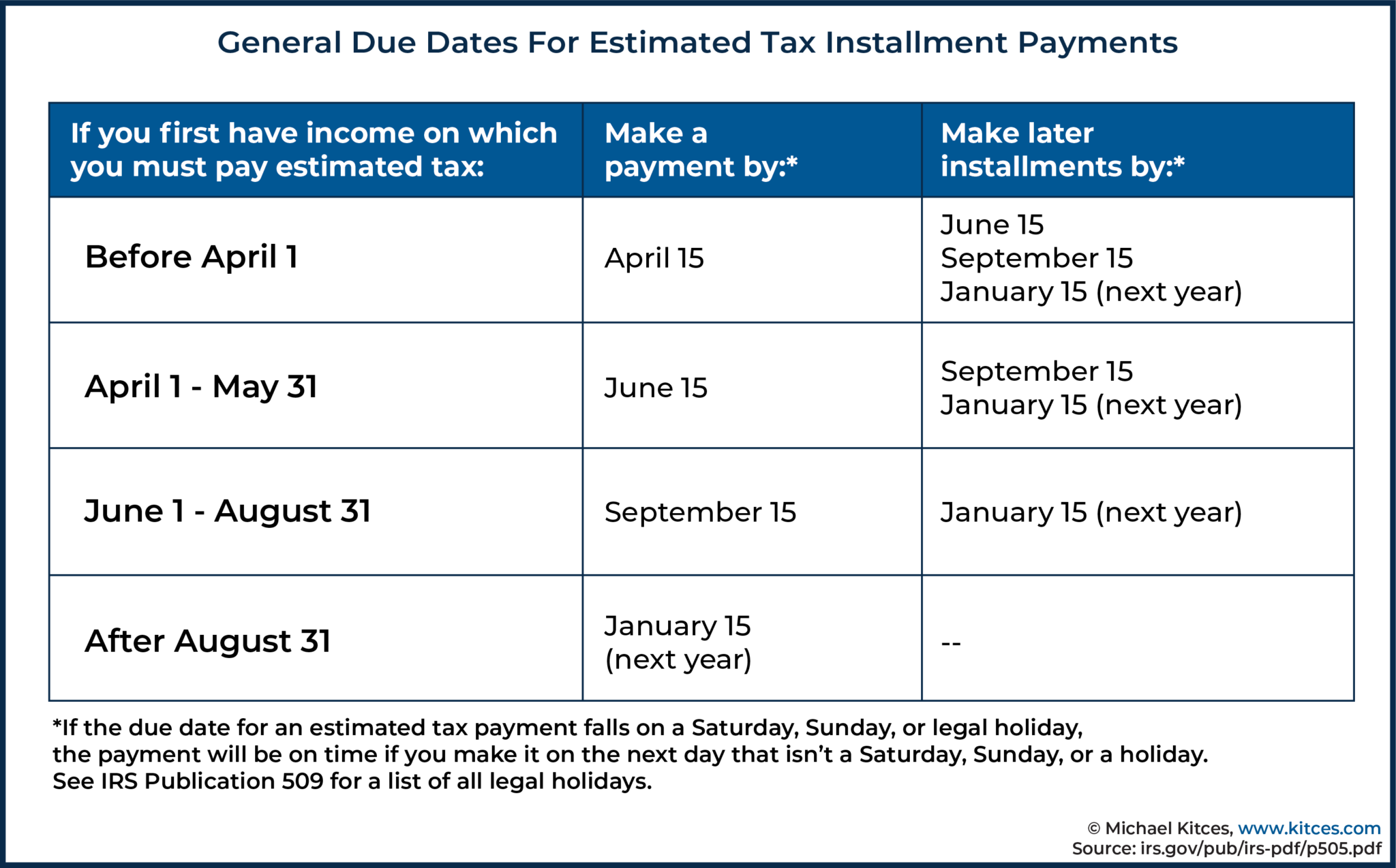

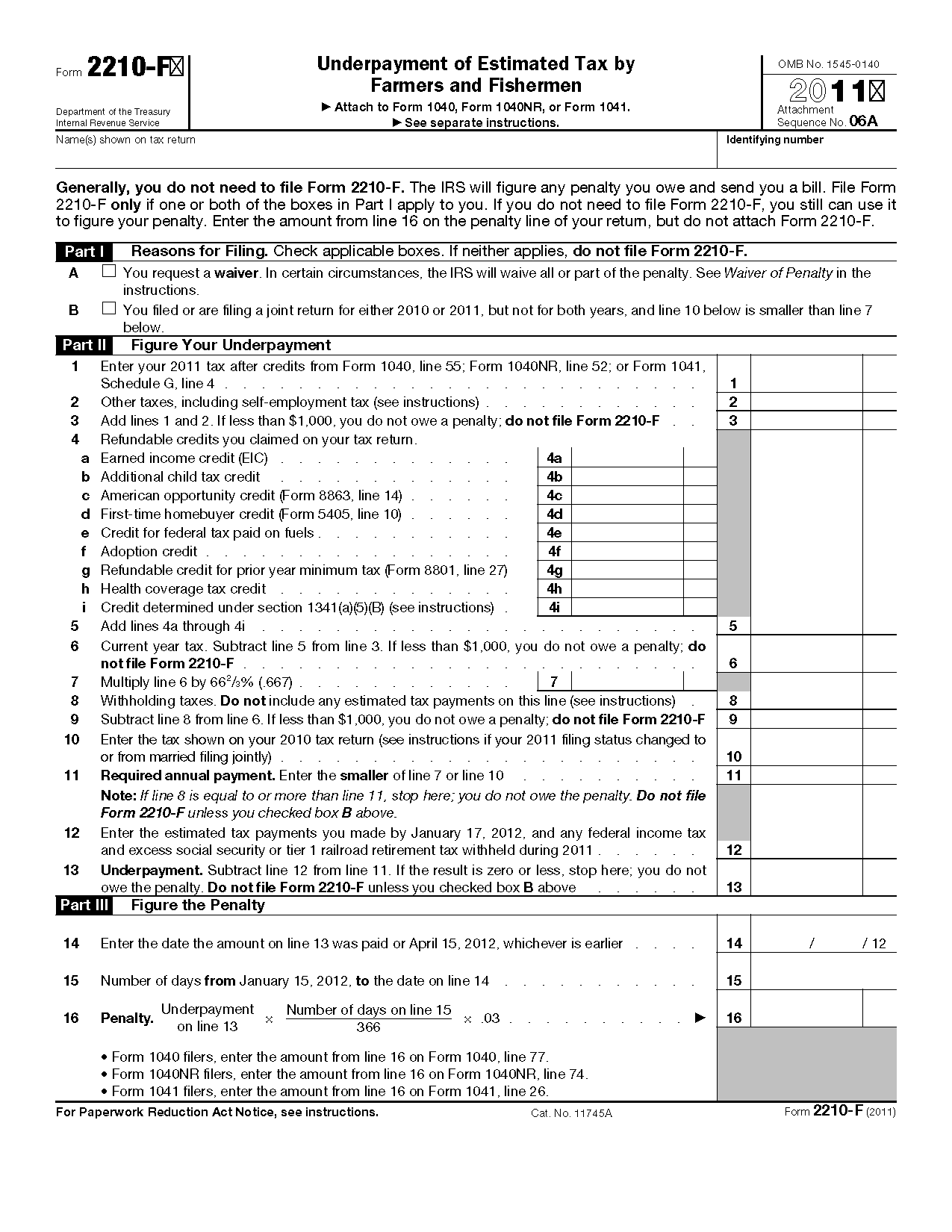

Quarterly estimated tax payments for the 2024 tax year will be due: Sign in to make an individual tax payment and see your payment history.

The Deadline To File Your Federal Tax Return And Pay Any Federal Income Taxes You Owe Is Monday, April 15, 2024.

The irs ctc payment 2024 is expected to go into impact beginning in july 2024 for all individuals.

Click On Each Irs Payment Option Below To Learn More About Common Ways To Pay Your Federal Income Taxes Online, What Each.

Estimated taxes are “pay as you go,” according to the irs, and are spread across four payments.

A Tax Checkup Will Help You Avoid Being Surprised With A Potentially Large Tax.

Images References :

Source: jobiqnadiya.pages.dev

Source: jobiqnadiya.pages.dev

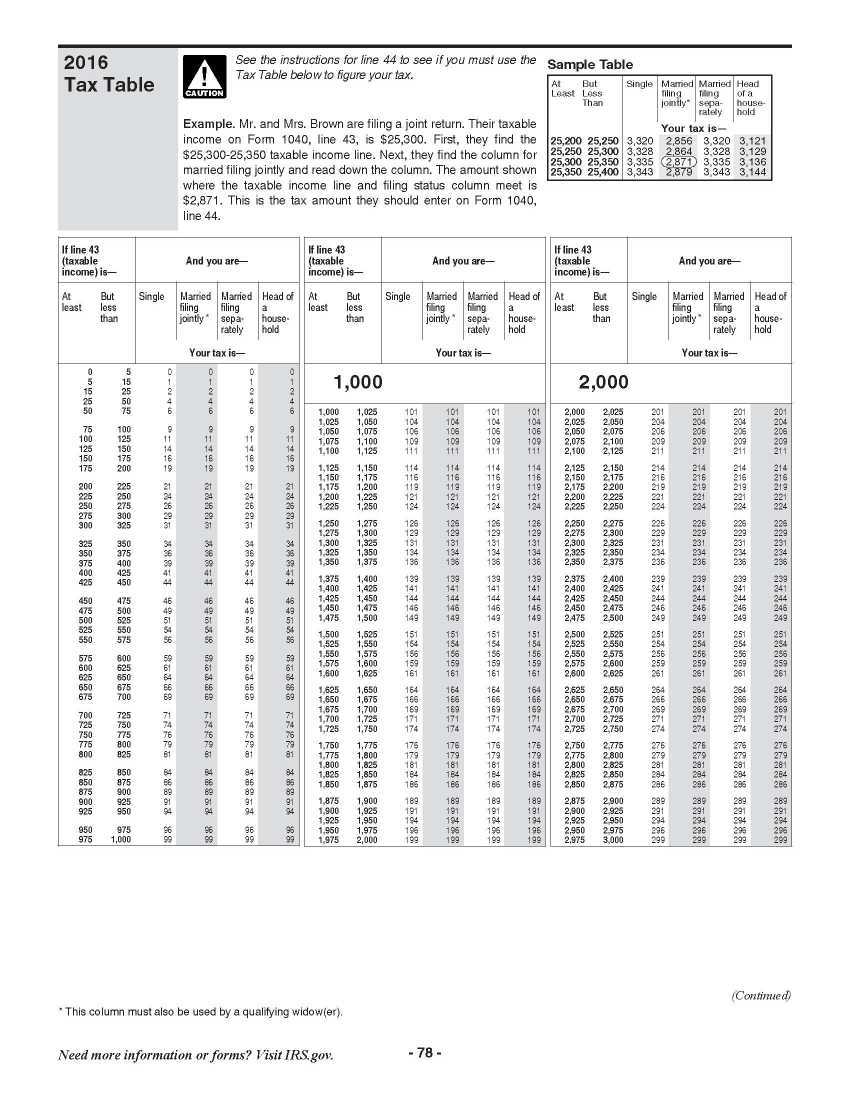

2024 Tax Estimate Calculator Irs Kyle Tomasina, Tax deposit deadlines vary depending on factors such as the type of return and past filing history, differing from. The irs is reminding taxpayers who need to make estimated tax payments that the 2024.

Source: adiqjenine.pages.dev

Source: adiqjenine.pages.dev

Irs New Tax Brackets 2024 Elene Hedvige, Taxes are due by april 15, which falls on a monday. Direct pay with bank account.

Source: violantewalene.pages.dev

Source: violantewalene.pages.dev

Irs Tax Brackets 2024 Pdf Halli Ronalda, For example, victims of december’s severe storms and tornadoes in tennessee now have until june 17, 2024, to file federal tax returns and make tax. The irs is reminding taxpayers who need to make estimated tax payments that the 2024.

Source: louisettewcarina.pages.dev

Source: louisettewcarina.pages.dev

Irs Estimated Tax Payment Dates 2024 Darcy Melodie, View the amount you owe, your payment plan details, payment history, and any. When is the filing deadline for 2024?

Source: yoshikowmandi.pages.dev

Source: yoshikowmandi.pages.dev

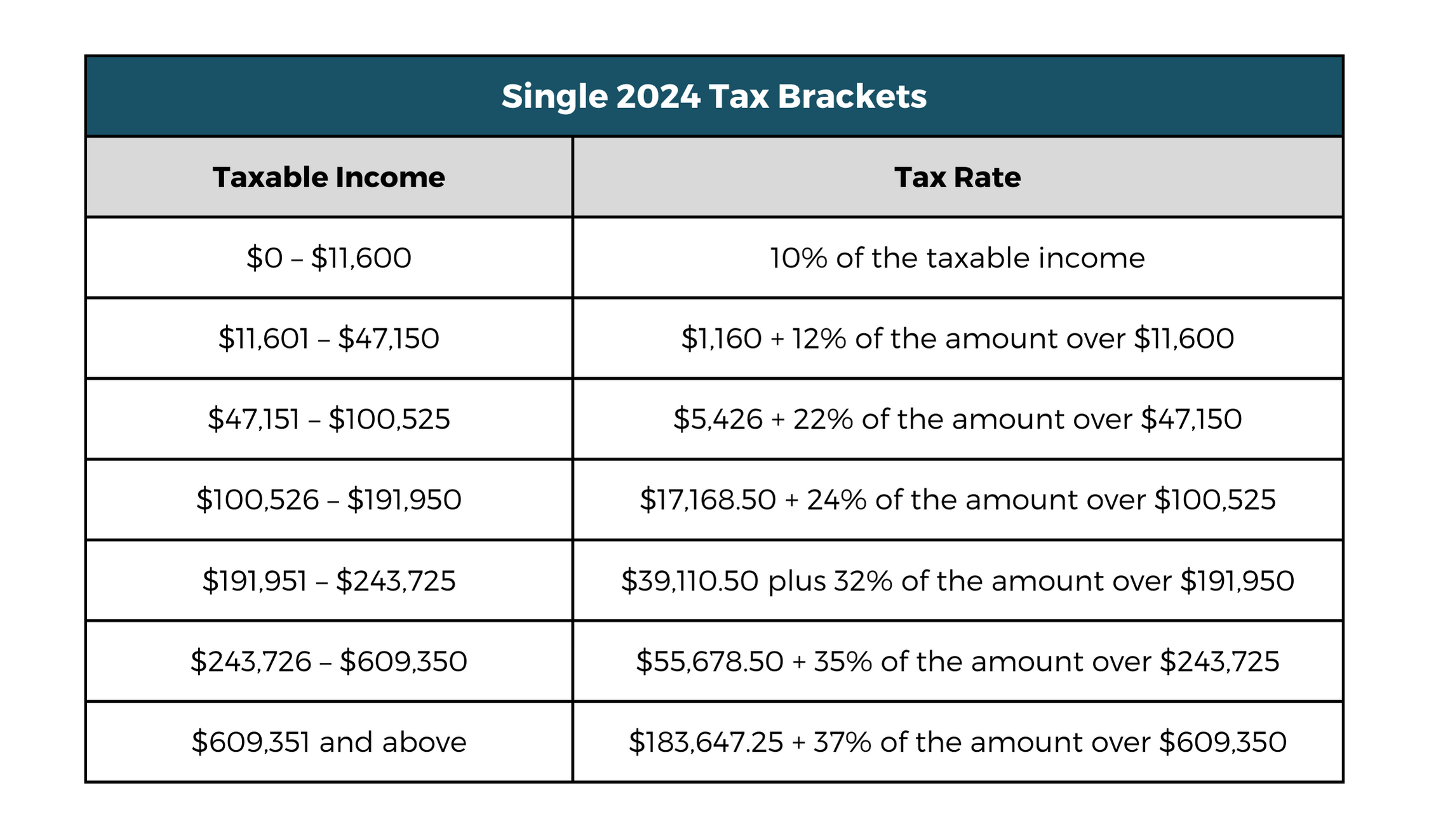

Irs Tax Brackets 2024 Calculator Evvie Wallis, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Use this secure service to pay your taxes for form 1040 series, estimated taxes or other associated forms directly from your.

Source: violantewalene.pages.dev

Source: violantewalene.pages.dev

Irs Tax Brackets 2024 Pdf Halli Ronalda, What else would change with the. The irs ctc payment 2024 is expected to go into impact beginning in july 2024 for all individuals.

Source: rgwealth.com

Source: rgwealth.com

2024 Tax Code Changes Everything You Need To Know RGWM Insights, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Quarterly estimated tax payments for the 2024 tax year will be due:

Source: daleqodelle.pages.dev

Source: daleqodelle.pages.dev

Irs 2024 Tax Tables Pdf Helyn Steffane, The irs estimated tax payment dates for the year 2024 are important for individuals, including sole proprietors, partners, and s corporation shareholders, who. Checkpoint federal tax update staff.

Source: halibsusana.pages.dev

Source: halibsusana.pages.dev

Estimated Tax Payments 2024 Irs Dacia Dorotea, Under the proposed bill, the maximum refundable amount per child would rise to $1,800 in 2023, $1,900 in 2024 and $2,000 in 2025. Use this secure service to pay your taxes for form 1040 series, estimated taxes or other associated forms directly from your.

Source: cassqmalvina.pages.dev

Source: cassqmalvina.pages.dev

2024 Tax Brackets And Tax Rates Freddi Robina, Filers may owe estimated taxes with. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

The Federal Income Tax Has Seven Tax Rates In 2024:

You will need to create an irs online account before using this option.

The Irs Is Reminding Taxpayers Who Need To Make Estimated Tax Payments That The 2024.

Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding.